Estate Your Business Part II: A Writer’s Guide to Organizing a Literary Estate

First of all, let me say hello and introduce myself. I’m an author of about half a dozen published short stories, one of which has just come out from Black Gate. I also, once upon a time, went to law school and for six years I worked as an attorney, first at a large firm, and then as a solo practitioner in northern New Mexico. I did real estate, contracts, and estate planning.

First of all, let me say hello and introduce myself. I’m an author of about half a dozen published short stories, one of which has just come out from Black Gate. I also, once upon a time, went to law school and for six years I worked as an attorney, first at a large firm, and then as a solo practitioner in northern New Mexico. I did real estate, contracts, and estate planning.

Northern New Mexico is crawling with writers and their kin and given I was active in the writing community it naturally followed that I did quite a few literary estate plans. I have since gone inactive in the bar, moved to London, and had two children who don’t ask me a lot of legal questions to keep me on my toes (yet), so please don’t rely on this post for hard and fast legal advice. I can, however, provide some general guidance about literary estates, what they are and how you get one.

What happens if I don’t have a literary estate?

That has already been answered on this site in Bud Webster’s illuminating first Estate Your Business post. In it he documents his hard work on the SFWA Estates Project, and all I can add is, don’t bank on there being a Bud Webster on the planet when you pass on. With a few simple precautions you can keep your body of work available to publishers, and thus available to earn money after your death, without a saintly individual like Bud burning up the phone lines to find whomever inherited your copyrights.

Bud explained what happens when you don’t have a literary estate, and I hope he convinced you to get one.

What is a literary estate?

This isn’t a precise term. It refers to whatever state of affairs a writer leaves behind when they die. I strongly recommend an organized literary estate, and by that I mean a trust that owns all of your copyrights after your death for as long as they remain in effect. Said trust must have a trustee, who in this case is often called the literary executor. This is the person who manages the intellectual property, signs contracts on behalf of the estate, and ensures that any proceeds go to the designated beneficiaries.

If you don’t set up a trust, your literary executor is the executor of your Will immediately after your death, and then ever after, whomever owns the copyrights. If you have multiple heirs, this can mean multiple people, which in turn can mean a real mess.

How do I set up a literary trust?

You get a lawyer, and no, that’s not me acting on bribes from my law school classmates. This is an important document, so get it done right. Ideally, it should only need to be done once, and please note, it does not have to be complicated. It might be as simple as one paragraph in your Will that instructs your executor to set up the trust and convey all of your copyrights to said trust. Then name your beneficiaries. You can make it more complicated if you like, but you aren’t required to do an extensive document with a table of contents.

How do I choose a literary executor?

Your copyrights will remain in effect for seventy years after you die. That’s a long time, so I’m going to switch to lawyer mode here. Imagine me looking you right in the eye. You need to pick someone Much Younger Than You. Someone whom you think of as a child. They may even be a child when you draft your literary estate. You must then also choose a successor trustee, and perhaps another successor after that. Don’t just name your agent, because your agent will probably not still be an agent seventy years after you die. Their agency may disband, or merge with another, or go under.

Your copyrights will remain in effect for seventy years after you die. That’s a long time, so I’m going to switch to lawyer mode here. Imagine me looking you right in the eye. You need to pick someone Much Younger Than You. Someone whom you think of as a child. They may even be a child when you draft your literary estate. You must then also choose a successor trustee, and perhaps another successor after that. Don’t just name your agent, because your agent will probably not still be an agent seventy years after you die. Their agency may disband, or merge with another, or go under.

Now, a practicing lawyer can walk you through all of the possibilities. Maybe you’ll want your descendants to be able to select and change your literary executor, or maybe you really do want your agent for as long as he or she stays in the field. In these cases, your lawyer should be able to devise a way to give you what you want and cover all eventualities.

In any case, you want someone who has some knowledge – or is likely at your death to have some knowledge – of publishing and contracts. You may also want someone who shares your particular vision of what kind of legacy you’ll leave behind, someone who won’t, say, license your works to the porn industry or Disney, or hire a ghost writer to keep writing books that run all of your ideas into the ground, assuming you don’t want any of these things. These personal considerations are just as important as the legal ones, so choose carefully.

Who are my beneficiaries?

Whomever you choose. Did you get that? Let me repeat it: whomever you choose. They do not have to be your descendants, though these are the most common choice. They can be your descendants plus the fan who came to your every signing, even the one you did in a parking lot in Detroit in January because whomever set up the signing forgot to tell the bookstore.

Whomever you choose. Did you get that? Let me repeat it: whomever you choose. They do not have to be your descendants, though these are the most common choice. They can be your descendants plus the fan who came to your every signing, even the one you did in a parking lot in Detroit in January because whomever set up the signing forgot to tell the bookstore.

They can be your neighbors, your Fedex delivery man, your daughter’s video game company, your favorite charity. It is up to you, though they do need to be people or legal entities. If you want to leave the earnings to your pets, that may be impossible, or will at the very least require a lot more legal work to set up. In many jurisdictions, you cannot make the lawyer who drafted your trust a beneficiary unless he or she is also a relative.

The purpose of having a trust is that you put whomever you think has the best business acumen in charge of handling your copyrights, and then give the profits to whomever seems right to you. Some jurisdictions, and some lawyers outside of these jurisdictions, will not allow you to make your trustee a beneficiary. Make sure to check on this.

What kind of restrictions can I put on my literary estate?

This can get complicated. You may decide not to put any restrictions on your literary executor and trust their judgment, but a lot of authors aren’t comfortable with that. You may limit where and how your work can be used. I won’t go into details, because there are a million of those, but let me touch on some general points.

First of all, I’m sure we’re all aware of how fast and how much the publishing industry can change. It may not be possible to write restrictions that make any sense seventy years after you pass on.

Secondly, note that only a limited class of people can enforce the terms of your literary estate. In most cases, only the beneficiaries can sue if your literary executor disregards your limitations. If your beneficiaries don’t care, then your literary executor may decide to do whatever they like. So, two subpoints:

- Bear this in mind when you choose your beneficiaries; and

- Consider putting in hurdles rather than barriers. For example, if you really don’t want your work to be used in a shared world anthology, consider the terms under which you would allow it. Maybe if your original book had to go back into print as well? Maybe if you could restrict the number of writers who could sharecrop? Maybe if your beneficiaries had to approve the project? If you put in a hurdle, then you have more say in the terms of any deal you’re not crazy about. If you put in a barrier, your wishes may be ignored entirely if they are unpopular with your beneficiaries.

Last of all, note that if your copyrights are lucrative, you may have tax planning issues to consider. In this case, I recommend you consult both an accountant and an attorney.

Those are the basics. You might keep yours simple by just choosing a literary executor and beneficiaries and have done with it. Or perhaps you now see how you can stay in charge of your intellectual property even when you leave this world and want to use the legal mechanisms to their fullest. Either way, you start with the same general principles.

Some practical stuff.

This isn’t an exhaustive list, but here are some practical considerations that I remember from my former career:

1) It may be impossible for your literary executor to find everything you ever wrote. If you can keep a detailed bibliography, that is ideal.

2) Some people like to have more than one literary executor. A lot of lawyers are willing to draft estates with two. For what it is worth, I was allergic to even numbers of executors. If one is in favor and the other is against something, they can cancel each other out. Make sure this issue is dealt with, or even better, have only one executor, or if you must have more than one, have three. Three is a lot, though, and rather unwieldy, which brings us back to my previous recommendation. Have one. Really. My views are skewed because I only saw the situations that went horribly wrong. Perhaps most two executor estates work beautifully, but when it goes wrong, it can be ugly.

3) As tempting as it is, do-it-yourself Will and trust software is not worth the money. When I started my solo practice, I actually bought one of these from a reputable vendor to use as a starting point for my own forms. It ended up being less than useless. I had to rewrite the entire documents from scratch, as in literally delete the entire thing and start over. It was a minor waste of money for me, it’d be a major waste of money for you. Lawyers who use and recommend this kind of software should also be avoided. Yes they exist, which brings me to:

3) As tempting as it is, do-it-yourself Will and trust software is not worth the money. When I started my solo practice, I actually bought one of these from a reputable vendor to use as a starting point for my own forms. It ended up being less than useless. I had to rewrite the entire documents from scratch, as in literally delete the entire thing and start over. It was a minor waste of money for me, it’d be a major waste of money for you. Lawyers who use and recommend this kind of software should also be avoided. Yes they exist, which brings me to:

4) How to find a reputable attorney. The website is www.martindale.com, and it provides a searchable directory of attorneys by practice area. There are several sites like this, but martindale.com provides something even more useful, peer ratings. There are three: CV, BV, and AV. CV is the lowest, AV is the highest and they are all good. If a lawyer has any of these, they are above average according to other lawyers in their field. A CV rated attorney is often early career, but already starting to shine. You are looking for an attorney who does estate planning. In that group, you want one with experience drafting trusts, and if possible, one with a working knowledge of intellectual property. Depending on where you live, you might not be able to get all of these.

5) You get what you pay for. I never understood people’s reluctance to pay good money on an attorney. One doesn’t go to a discount doctor for cancer treatment. Your Will or trust is a document that Will Get Used, and if you want one worth the money, go to a lawyer who commands a respectable fee.

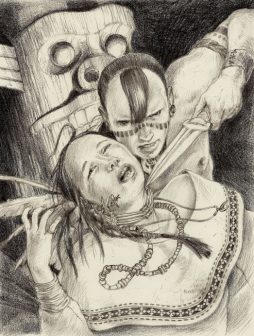

6) You’re normal if you don’t think this is fun. Planning for your death usually isn’t. Take it from a former estate planning attorney, you are allowed to be neurotic and emotional (just don’t be threatening and leave your swords and other costume weapons at home). It’s okay to go to a free consultation, go home and think it over, and then choose someone else. Any successful lawyer knows that being pushy, overbearing, and unsympathetic leads to poor client relationships and poor work as a result. It wasn’t unusual for me to consult with a person months, or even a year before they came back to draft documents. It’s a part of the business, and anyone who tells you otherwise isn’t worth your time.

Well done, Emily. In support of literary heirs being “whomever you choose,” you may not be aware that the inestimable Alfred Bester left his literary estate to none other than his bartender, one Joe Suder. This isn’t as careless a choice as you might think; Alfie and Joe were friends, meeting at Suder’s establishment when Bester went to the post office. Suder was a big fan of Bester’s work, and actually set aside a room in his own house for Bester’s library.

Thank you, Emily! The advice about providing a way for beneficiaries to choose successor literary executors is especially helpful. After all, Congress will probably keep extending copyright to cover Disney’s claim on Mickey Mouse, so by the time writers of my generation are mostly gone, copyright could last a very long time indeed.

I half-recall a Harlan Ellison short story about the travails of a literary executor, a writer who’d been named in that capacity by a friend’s will. Taking care of his late friend’s estate totally derailed the main character’s life, and I got the impression Ellison had seen that kind of thing happen to people he knew. Whoever you name, ask them first!

Hi guys, what great anecdotes! I wasn’t aware of either, though Sarah, I do now want to see if I can dig up that short story. Sounds like it must be based on a true story of some kind.

And yes, always ask people before putting them into your estate plan. Excellent point!

Fantastic tips on organizing a literary estate! Ensuring that our creative legacy is preserved is crucial. Thank you for sharing such valuable guidance for writers!